The crypto market more often becomes the source of investors’ optimism

September 28, 2018 @ 14:35 +03:00

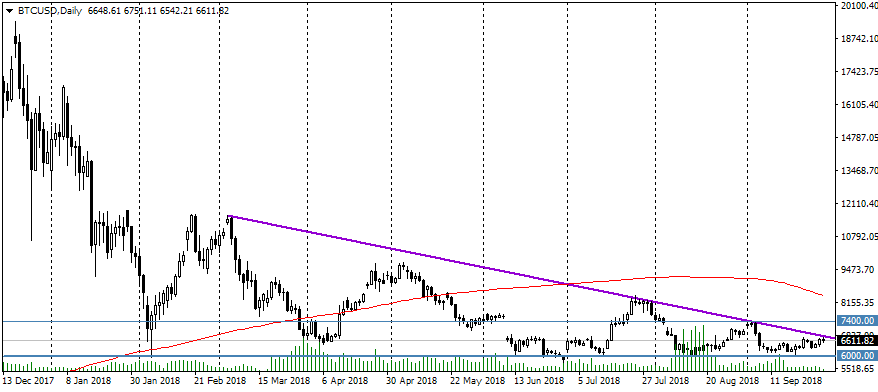

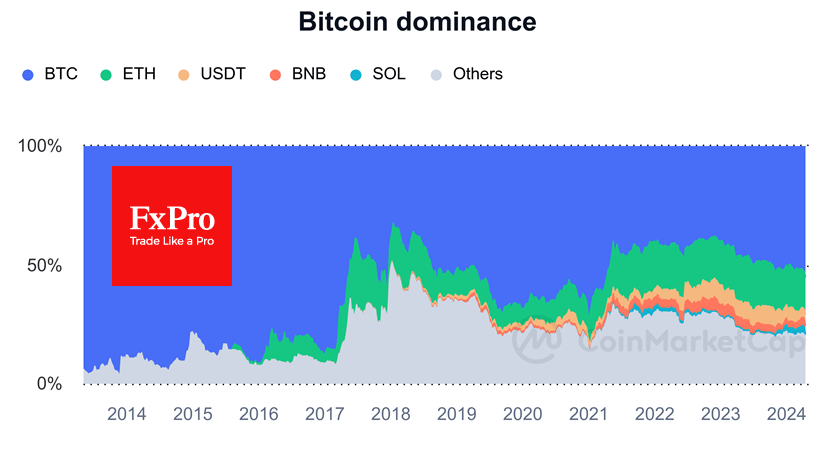

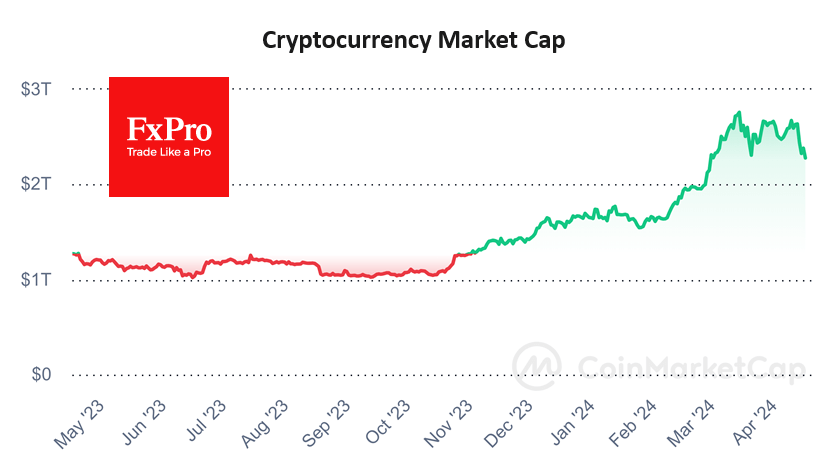

At the beginning of the last working day of September, Top-100 cryptocurrencies are showing growth from 4.5% by Bitcoin (BTC) to 45% by Electroneum (ETN). Overall capitalization can’t get out of the $250 bln range, starting from August 2018. In case of confident growth to $300 bln, the market can take it as a new signal to rally.

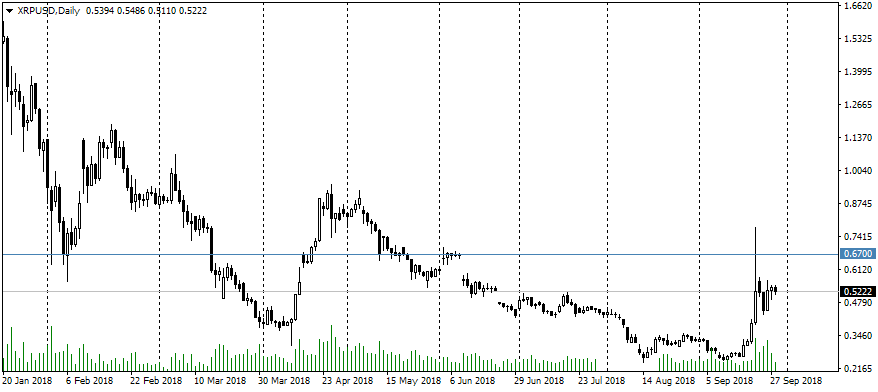

The XRP and Bitcoin Cash (BCH) recent rapid growth made the market’s mood brighter. The crypto market community charged rally with “Pump&Dump” scheme but now it’s seems that both cryptocurrencies managed to hold gained growth. The Bitcoin Cash (BCH) has increased sharply over the past few days by 25% (more than $ 100) due to the successful filing of an IPO by the leading mining producer Bitmain which, in addition to its main business, owns a significant share of BCH (over 1 million coins). Crypto investors decided that IPO would have a positive impact on all Bitmain assets. The XRP growth linked with the announcement of the world’s largest crypto exchange Coinbase on the revision of the cryptocurrencies listing process based on the demand for new assets including XRP.

Meanwhile, the blockchain continues to attack traditional banking technology SWIFT. In addition to actively promoting, fast transfers based on Ripple’s protocols, the Veem start-up was able to raise $25 mln in a round of funding led by Goldman Sachs, and this start-up also promises to reduce fees and make money transfers faster, safer and more reliable. There is an opinion (based on conspiracy theory) that cryptocurrencies creation was financed by corporations which are desperately need quick and reliable way to hide money in new “digital off-shores”. Anyway, cash transfer sector shows a truly serious positive transformation.

The next stage in the development of crypto-exchange development will be emergence of “stable coins”, which would be used by analogy with the Fed’s printing press. The next stable coin is “USD Coin” issued by Circle, which in turn belongs to the Poloniex exchange. Probably, we will see a new formation of “Pump & Dump” schemes soon.

Summer is over, investors and regulators are going back to work. The news background is gradually becomes more pronounced. Obviously, the cryptocurrency demand is on: perhaps many market participants have become disappointed, but we already saw many times of how market’s dynamics can quickly unfold from black to white.