Golden Cross or another selloff: what is around the corner for BTC?

May 17, 2019 @ 12:54 +03:00

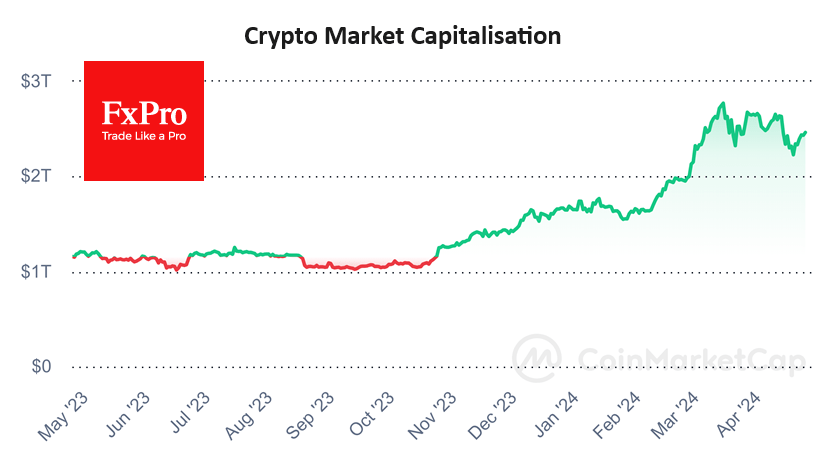

The inability to stay above $8K threshold resulted in a Bitcoin drop of $1,400 in just a few hours. Over 24 hours, the first cryptocurrency lost more than 9% to $7,300, only partially recovering from a decline to $6,600. Apparently, some players decided to quit Bitcoin, considering the rally to be exhausted. Market watchers noted that the decline was caused by a large, by several thousand Bitcoins, order for sale on Bitstamp. It also became a trigger for price correction for the main altcoins, most of which lose more than 10% against the levels of the previous day.

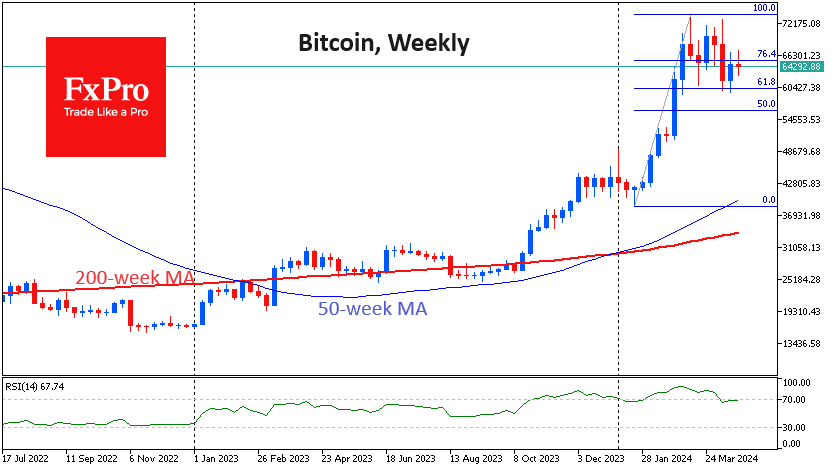

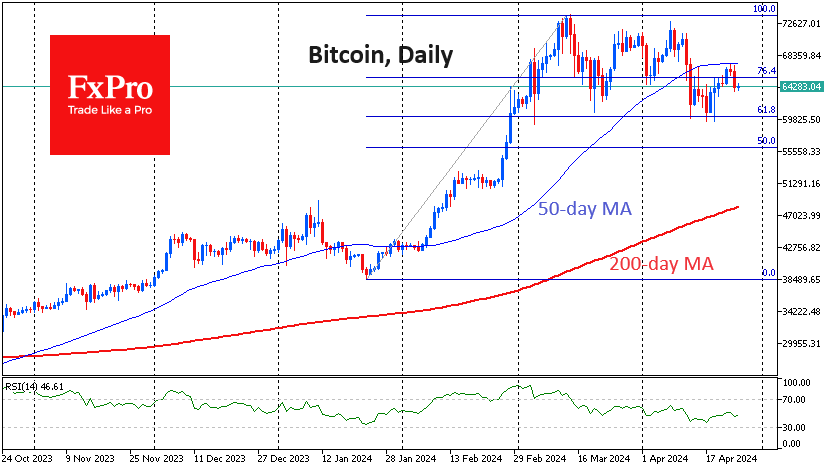

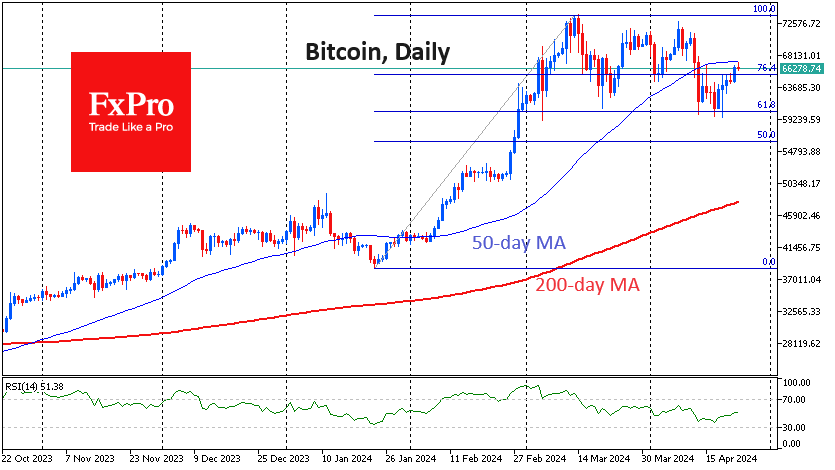

As for technical analysis, Bitcoin stumbled over the resistance level near $8,200, which in July last year also stopped the growth. The relative strength index RSI on the daily charts marks a divergence as new price highs are not confirmed by new index highs. Even more alarming, the RSI fell sharply in the region below 70, probably marking the beginning of a longer correction.

Interestingly, the sale occurred just the day after the 50-day average crossed the 200-day bottom-up. In technical analysis, this is considered a strong buy signal called the Golden Cross. If the correction does not receive an impulse below $6,000, then new buyers may rush to the market, buy on a pullback.

Against the background of increased volatility, the US SEC postponed consideration of an application to launch Bitcoin-ETF from Bitwise. Such a prolonged expectation can increase the market reaction in the event of a positive decision at some point in the future.

The upcoming weekend may determine the further direction of the BTC price dynamics and the entire cryptocurrency market as a whole. For the time being, there are more signs that the pullback can be short-lived, retaining the generally upward bias of the bitcoin price for the coming months.

The FxPro Analyst Team