Crypto market is on the defence but remains optimistic

August 27, 2020 @ 15:53 +03:00

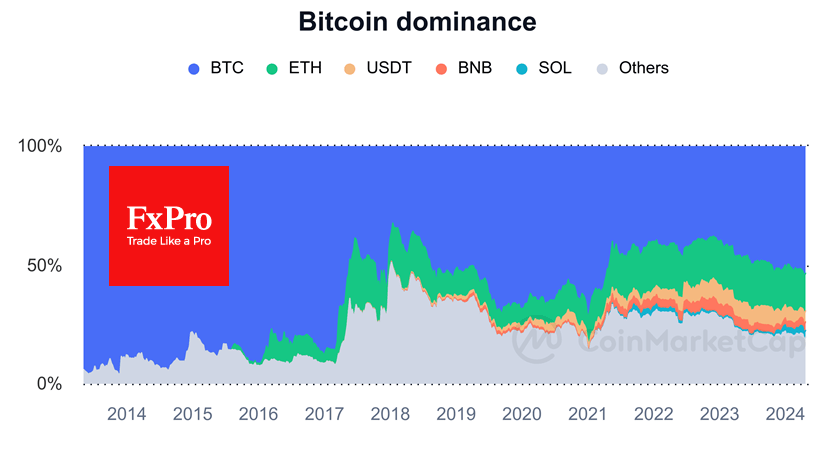

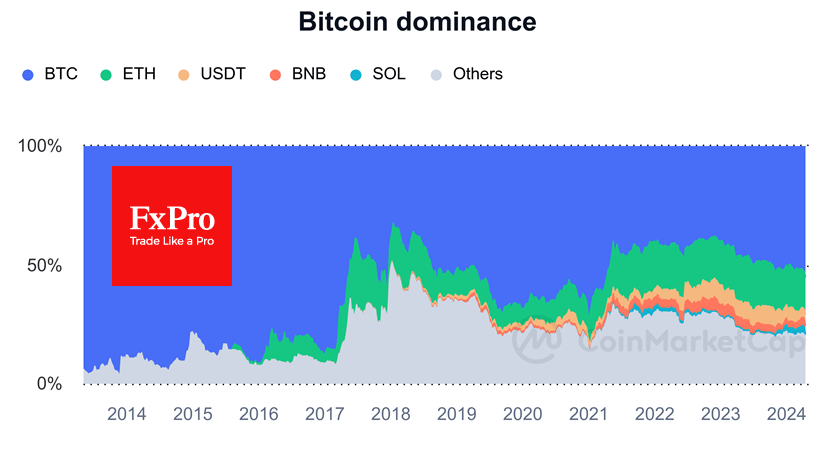

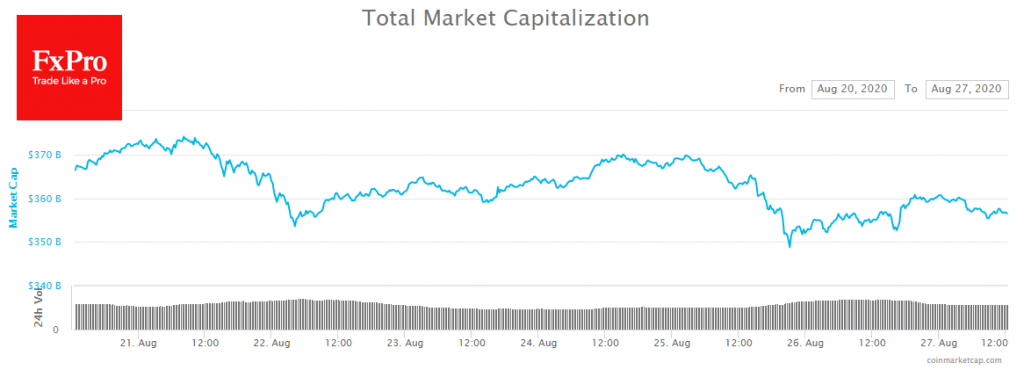

Over the week, the crypto market lost 2.5% of capitalisation, which is not significant by its standards. However, most of the digital currencies were in the red zone, including the TOP-10. The Bitcoin Domination Index remains at 59% as further declines may indicate healthy interest for altcoins. The pandemic is one of the main factors of returning growth to cryptos, as a number of investors have turned their attention to Bitcoin and other digital coins as an alternative to traditional markets.

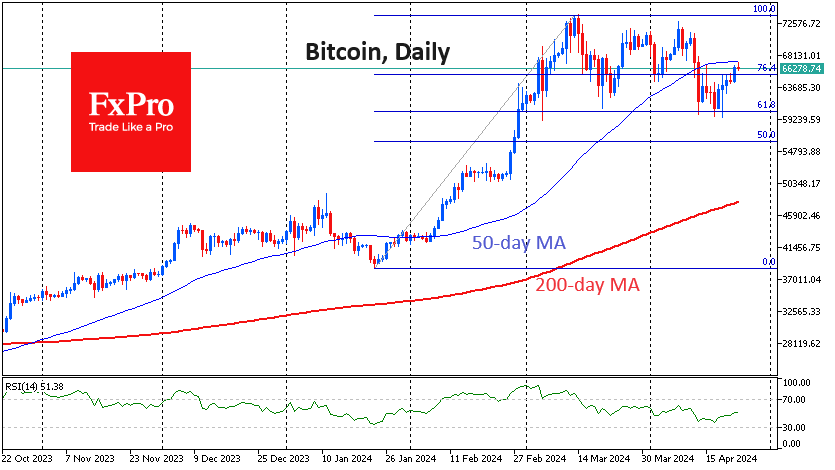

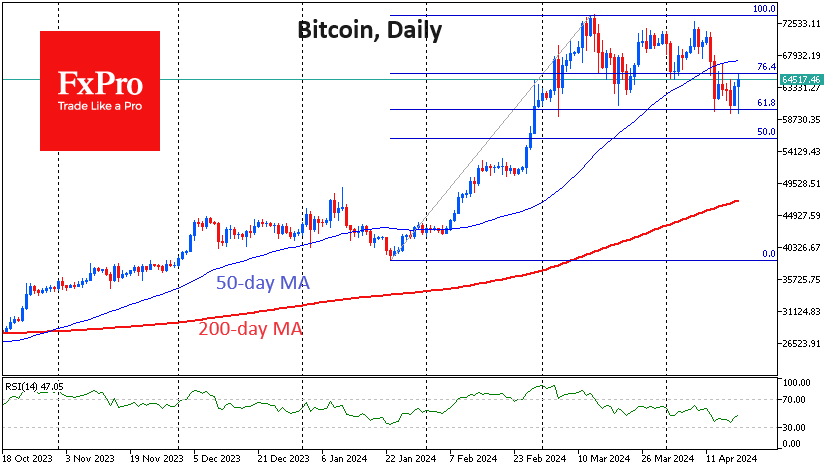

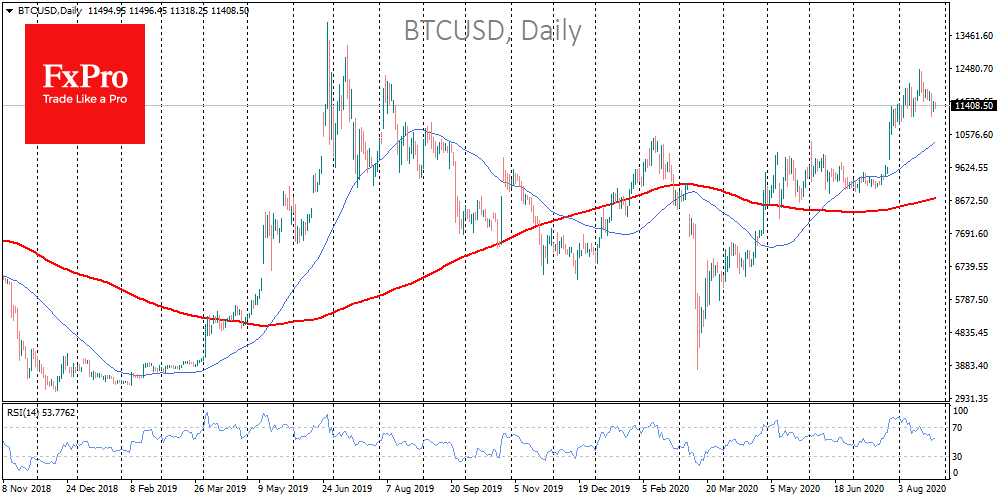

At the end of July, Bitcoin managed to climb above $10K and held above this threshold for a month. Now the views of the participants in the crypto market are looking to the future with some anxiety. Just over a year ago, BTCUSD got stuck trying to rise above 12,000. It recently stalled close to these levels once again.

The pullback below will lead to a double-top figure with a possible low point at $4000, the March lows and the levels of consolidation thought December 2018-March 2019.

However, there is a better chance that this time the advantage will be on the bull’s side. Technically, Bitcoin has stood up against the recent impulse and no longer looks overbought in the short-term.

Fundamentally good news is coming from Glassnode. There are currently 2,190 wallets that hold 1K or more bitcoins with 8 million BTCs or almost $90 billion. The concentration of capital in cryptocurrencies continues, which opens the way to higher prices.

Besides, decentralised financial applications (DeFi) are becoming an increasingly frequent topic. According to DeFi Pulse, the total amount of blocked funds in decentralised financial protocols has increased by 271% over the past few months, exceeding $7 billion. As with Bitcoin, a small number of DeFi projects account for more than 90% of all capital blocked in this sector.

By the end of the year, the capitalisation of decentralised financial applications could grow by a further $20 billion. It is difficult to call these game-changing numbers for the entire market, but this rapid growth indicates a bright outlook for the sector over the next few years. The largest projects in this sector are Aave, MakerDAO, Curve Finance and YearnFinance.

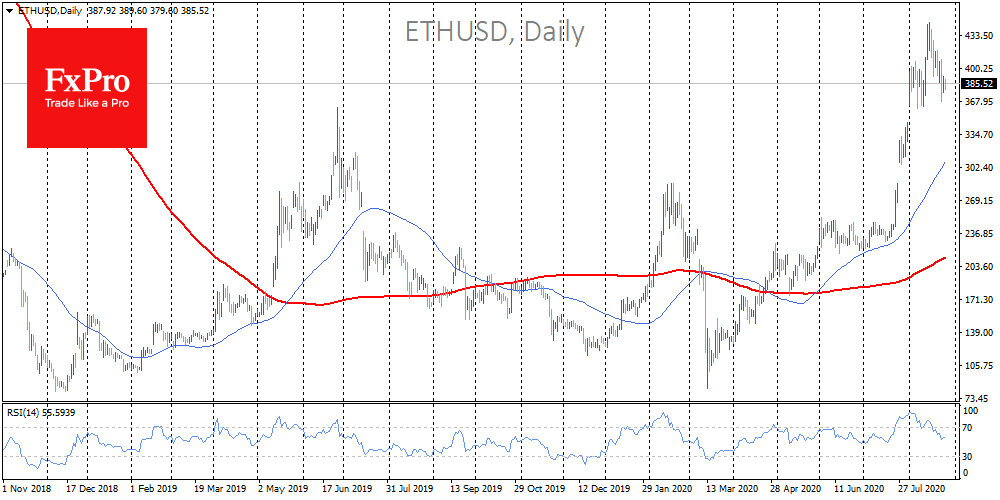

On Friday 28 August, $112 million in Ethereum options will expire. The expiration of options is likely to have an impact on the short-term outlook of the coin. The leading altcoin has fallen below $400 recently. However, the sentiment of market participants is still positive as we approach the launch of the second version of the Blockchain and high demand from the stablecoin market.

The FxPro Analyst Team