Bitcoin: from rapid growth to panic selling in just one year

November 20, 2018 @ 17:05 +03:00

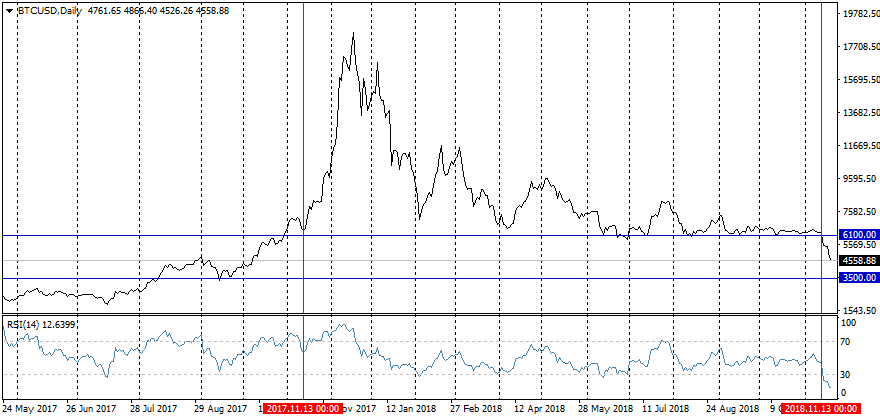

Last week’s sell-off seemed to be a turning point for the crypto market. During this week only, the price of Bitcoin (BTC) has fallen by 20%, trading below $4,400 at one point. It is worth noting that this was not a single sharp collapse as last week, but rather a systematic sell-off throughout the day. Markets participants are trying to sense whether this is the bottom, however no sure answer can be given.

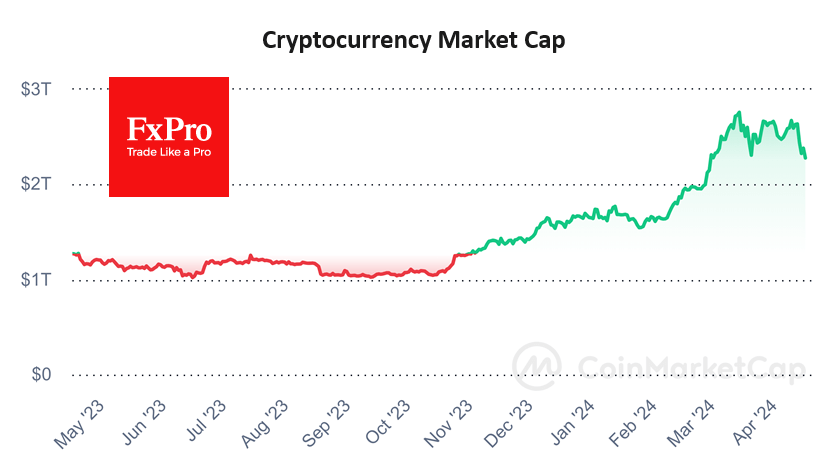

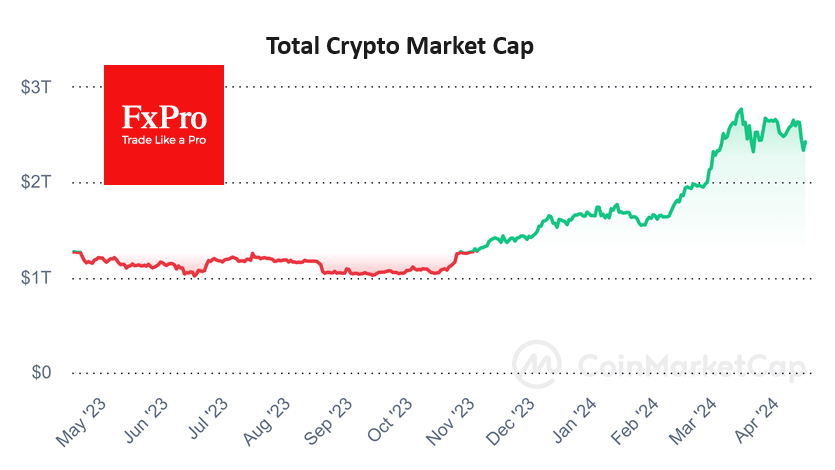

Over the past week, the world’s leading cryptocurrency fell by $1,650 and at the moment there are no signs of recuperation. Bitcoin (BTC) was under intense pressure after breaking through the consolidation zone which was formed over the previous few months. The total cryptocurrency market capitalization plummeted by $52 billion over the week and market turmoil spiked the average daily trading volume by 62%. All TOP-100 altcoins are in the red zone, but nevertheless there are winners and losers.

For example, in the last 24 hours, Bitcoin Cash (BCH) has fallen by 45%, trading at around $200 (-63% against last week’s value). This is the payback for the controversial hardfork that provoked a fierce fight between two chains: ABC and SV. Some market participants consider the Bitcoin Cash (BCH) hardfork as the starting point of a new correction phase, but it is highly probable that this is just a coincidence. However, tensions may have fatal consequences for the entire project.

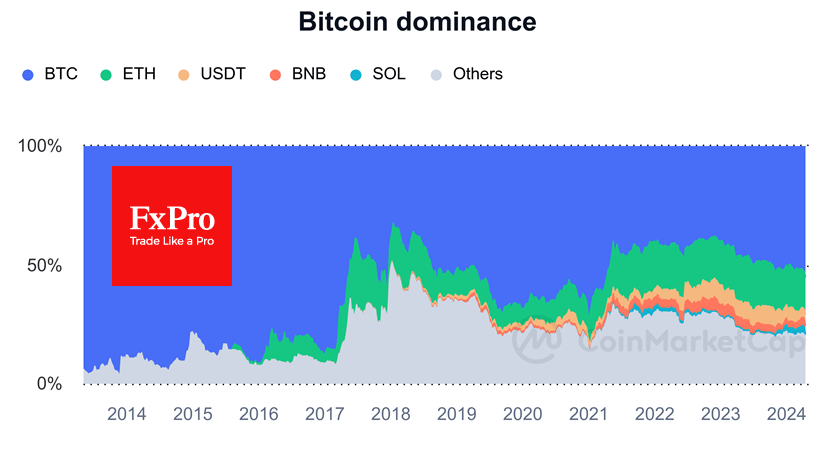

Against this background, the XRP token, which lost only 4% in the last 24 hours, looks like a safe-haven investment. The token is trading at around $0.45, with almost no loss in its value for the week. Within this context, XRP has recently shown a significant increase of trading volumes from $0.5 to $1.34 billion. Meanwhile, Ripple seems to attract the attention of market participants due to its business model. This demand for safety allowed XRP to push Ethereum (ETH) from the second place to third in terms of capitalization. Now the gap between the cryptocurrencies is $5 billion.

The only question now is how low the new correction will turn out. Experts predicted a decrease in Bitcoin (BTC) to the area near $3,500, at which point the cryptocurrency will stabilize and receive some support from market participants. At the moment, we have the same “hype factor” which pushed BTC to $20,000 last year, but however in the opposite direction: from rapid growth to extreme fear and sell-off.