Bitcoin fights for $50K and independence from stocks performance

March 04, 2021 @ 17:30 +03:00

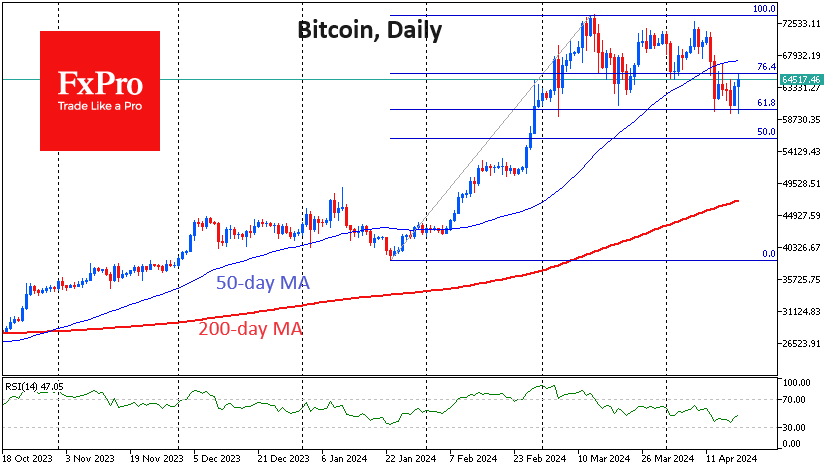

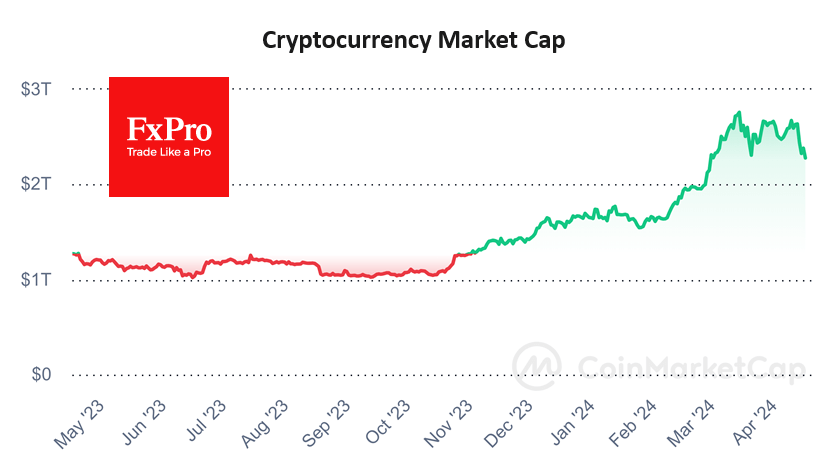

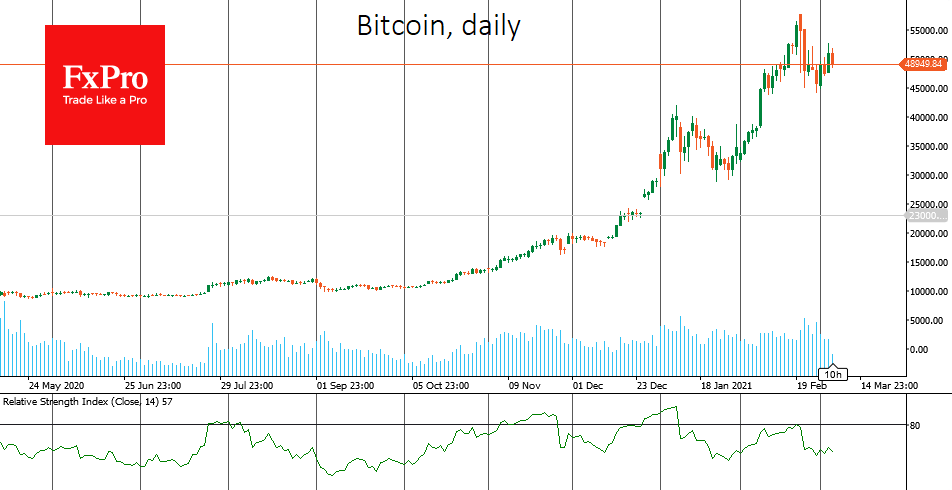

Crypto-enthusiasts are struggling to keep the Bitcoin price above $50K. The benchmark cryptocurrency dipped briefly below $49K on Thursday morning, but buyers soon decided to support it, bringing the price back above $50,500, where sellers are now back in play. The bulls and the bears continue to play tug-of-war around the psychologically important level. A solid growth above this level could bring buyers back into cryptocurrencies, proving that earlier in February, we saw a consolidation rather than a price maximum for years to come.

After Bitcoin’s impressive rebound and breaking $50K, crypto market participants will be waiting for further gains and fighting for new highs above $58K. If this level is successfully surpassed, the benchmark cryptocurrency will be on its way to setting a new all-time high. Probably, in the case of successfully overcoming the resistance level, we may see a test of $60K.

Glassnode’s research showed that only 4 million BTC are in free float on the market. The third halving in the Bitcoin network, which happened in May 2020, halved miners’ reward per mined block from 12.5 BTC to 6.25 BTC. This further exacerbates the shortage of coins on the market. At the same time, businesses have actively invested in Bitcoin and major payment applications, including PayPal and Square, have added the ability for their users to buy and sell digital assets.

Market participants continue to monitor Bitcoin addresses that have been in sleep mode for a long time. Analysts have concluded that every time old coins start moving, it coincides with a market correction. Right now, 1,000 BTCs that have been untouched since 2010 are being moved. So, combined with what is happening in the traditional market, we may well see a new plunge in Bitcoin and the crypto market as a whole.

Events in the stock market will now have one of the leading roles in influencing Bitcoin and the crypto market as a whole. Although the Fed is taking all steps to ease the situation, US ten-year bond yields have gone back up, and the market has reacted with a decline. A little more than a year ago, panic sentiment around the pandemic caused the stock market to plummet and triggered the Bitcoin crash.

The FxPro Analyst Team