Altcoins pull the crypto market up

April 06, 2021 @ 16:17 +03:00

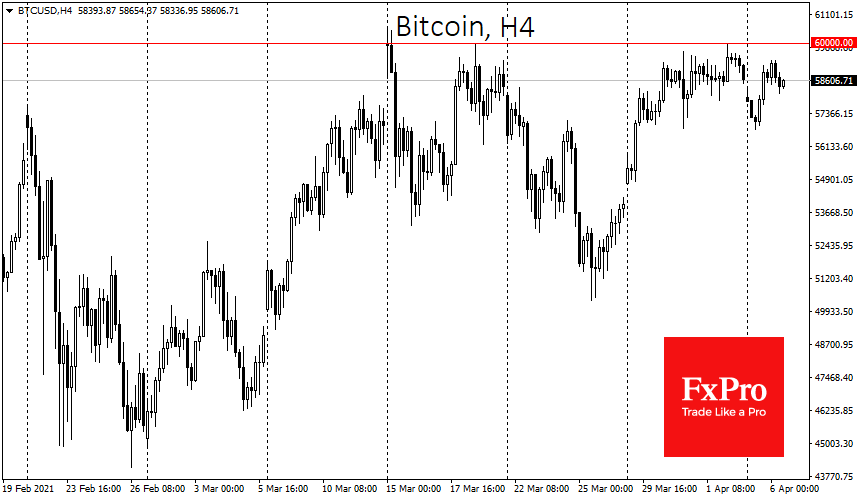

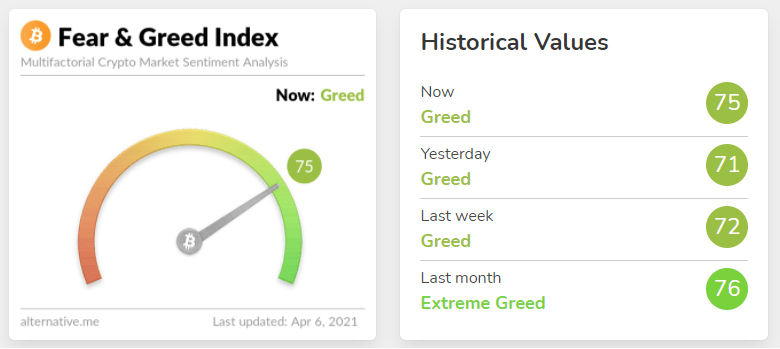

The crypto community expected Bitcoin to continue to rise after breaking $60k, but the weekend rally never happened, and the round level remains as very serious resistance. As a result, Bitcoin is showing zero price dynamics at the beginning of the working week and is trading just above $58,000. The Crypto Fear & Greed Index for Bitcoin and major cryptocurrencies decreased by 3 points during the day, which corresponds to the “greed” mode in moderate form, demonstrating that there is still room for growth.

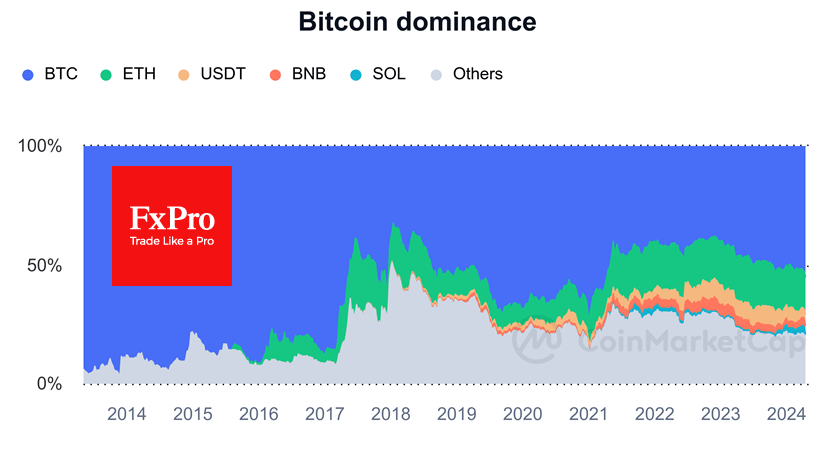

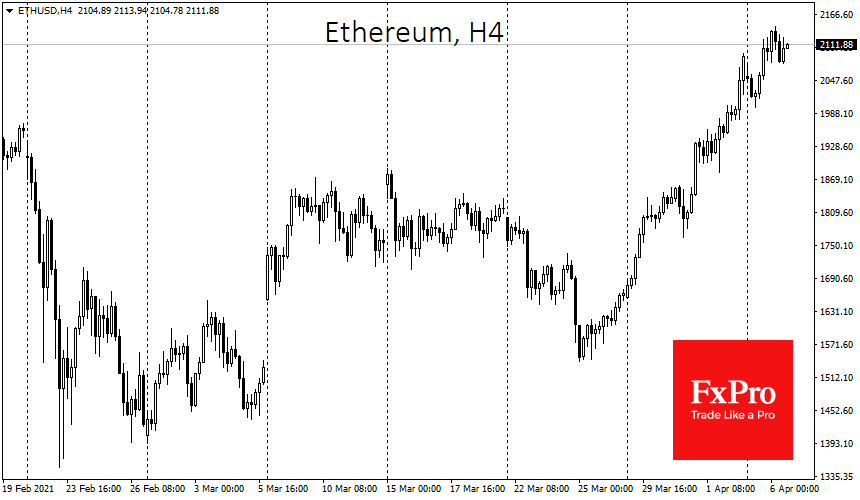

During the week, Bitcoin lagged behind other cryptocurrencies in terms of momentum. The leading altcoin Ethereum (ETH) showed a 20% gain for the week. BitTorrent token appeared in the top 10 coins, showing a jump of 281% over the last 7 days amid active updates of the project, which affects decentralization. Other members of the list of leading cryptocurrencies show a 20-30% jump during the week, due to which Bitcoin’s dominance index declined to 56%.

Market participants have a mixed attitude to what is happening. On the one hand, such impressive growth may point to the increasingly active “altcoin season.” On the other hand, Bitcoin’s weak dynamics against the background of active growth of alternative cryptocurrencies evokes disturbing associations with the beginning of 2018, when retail investors used their last money to buy very high-priced video cards for mining in the hope of continued growth. This was the starting point of the crypto winter, although, at the moment, we do not see one of the main conditions for a trend reversal – a significant drop in Bitcoin.

The actions of Bitcoin whales will now receive special attention, as everyone understands that it is the large market participants who make the main contribution to the price dynamics. The main difference from 2017 is that impulsive sell-offs by non-professional investors are no longer able to reverse the trend in general. Just recently, the cryptocurrency community noticed a sudden activation of whales. Over one night on April 3rd, more than $2 billion worth of bitcoins were moved.

It’s likely that there are underlying processes going on in the market that are less visible to the community. To sell Bitcoins, you don’t have to move them to new wallets. You can give up your access keys to the asset, which is probably what most big players do, so as not to cause shock waves in the market.

Tyler Winklevoss, the CEO of Gemini crypto exchange, provided an answer to exactly how the U.S. government might respond to Bitcoin’s growing popularity. One of the most famous crypto investors in the world believes that the U.S. regulator won’t ban the circulation of BTC, as it could be a very problematic solution for the authorities themselves. Construction of infrastructure, a large number of court decisions, as well as the complexity of blocking Bitcoin technology will lead to the fact that the cryptocurrency will try to integrate into the broad market and make its operation more and more dependent on big capital, which is what we are witnessing now.

The FxPro Analyst Team